Market insights for exporting Agriculture and Fisheries to the World

The global demand for agricultural and fisheries products continues to rise, driven by population growth, evolving consumer preferences, and the shift towards sustainable sourcing. Countries like Indonesia, with abundant natural resources, are well-positioned to supply high-quality agricultural and fisheries commodities to the international market.

This article outlines important insights and considerations for exporters aiming to compete in the global agriculture and fisheries sectors.

Global Trends in Agricultural Commodities

International buyers are increasingly seeking agricultural products that are organic, sustainably sourced, and traceable. Commodities such as spices, coconut derivatives, tropical fruits, and herbal products are in high demand.

Current trends include:

Rising consumption of turmeric, ginger, and cinnamon for health-conscious markets

Growing demand for coconut-based products such as cocopeat and cocofiber

Increased interest in exotic fruits and natural food ingredients

Preference for eco-friendly packaging and low-carbon production processes

Countries in Europe, North America, and the Middle East are key buyers, especially for value-added and ethically sourced agricultural products.

Key Export Markets for Agriculture

Europe:

The EU market values certified organic, fair trade, and sustainably produced goods. Exporters need to comply with stringent pesticide residue limits and labeling requirements.

United States and Canada:

These markets demand consistent quality, strong branding, and FDA-compliant packaging. There is a rising preference for health products derived from traditional plants such as turmeric and moringa.

Middle East:

Markets like the UAE and Saudi Arabia import large volumes of fruits, vegetables, and coconut products. Halal certification and shelf-life stability are critical.

Asia-Pacific:

Neighboring countries like China, South Korea, and Japan offer strong demand for tropical produce and herbal ingredients but require strict phytosanitary controls.

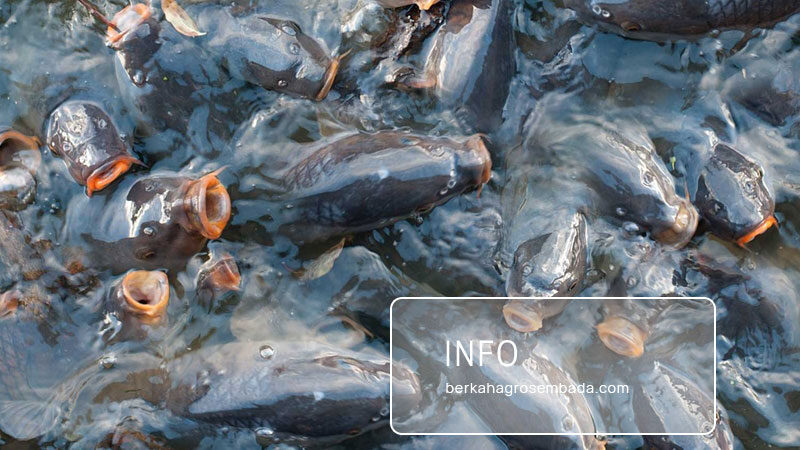

Fisheries Product Trends and Opportunities

Fisheries exports are among the fastest-growing segments of agri-food trade. Consumers seek safe, sustainable, and traceable seafood—fresh, frozen, or processed.

High-demand products include:

Frozen fish fillets and whole fish

Dried seafood and salted fish

Shrimp and squid

Seaweed and algae-based products

Buyers increasingly request certifications such as MSC (Marine Stewardship Council), HACCP, and traceability systems.

Top Export Markets for Fisheries

Japan and South Korea:

These countries demand high-quality seafood with strict hygiene standards. Product presentation and packaging play a major role in acceptance.

China:

The largest global seafood importer, China looks for both raw and semi-processed fish, with specific preferences by region. Prices and volume capacity are key.

United States:

Frozen and value-added seafood products are preferred. Labeling, sustainability claims, and FDA registration are essential.

European Union:

Imports focus on eco-label certified fishery products. Traceability, catch documentation, and veterinary inspection reports are mandatory.

Logistics and Cold Chain Management

Timely and temperature-controlled logistics are critical for both agriculture and fisheries exports. Exporters must ensure:

Cold storage for perishable items

Real-time monitoring during shipment

Minimal handling to avoid contamination or spoilage

Investments in cold chain infrastructure help improve shelf life and product reliability upon arrival in destination markets.

Regulatory Compliance and Certifications

To compete globally, exporters must comply with both domestic and foreign regulations. Requirements may include:

Phytosanitary certificates (for plant-based products)

Sanitary certificates and catch documentation (for fishery products)

Organic, Halal, or Fair Trade certifications

Good Agricultural Practices (GAP) or HACCP implementation

Understanding destination market regulations helps avoid rejections and builds buyer confidence.

Sustainability and Traceability Expectations

Modern importers demand not just product quality, but also ethical sourcing and transparent supply chains. Exporters should invest in:

Farm or fishery traceability systems

Eco-labeling and environmental impact reporting

Social compliance (fair labor practices, community empowerment)

Such commitments enhance brand image and access to premium markets.

Conclusion

The agriculture and fisheries sectors offer significant export potential for businesses that can meet international standards, manage quality, and respond to global trends. Exporters that embrace sustainability, invest in logistics, and build market intelligence will be better positioned to thrive in the competitive global marketplace.